INVENTORY SHORTAGE CONTINUES TO PUSH MEDIAN SALES PRICES HIGHER

Market closely watching potential ramifications of inflation, mortgage rates

March – National Real Estate Commentary

Nationally, existing home sales recently dropped to a 6-month low, falling 7.2% as buyers struggled to find a

home amid rising prices and historic low inventory. Pending sales are also down, declining 4.1% as of last

measure, according to the National Association of REALTORS®. Builders are working hard to ramp up

production—the U.S. Census Bureau reports housing starts are up 22.3% compared to a year ago—but higher

construction costs and increasing sales prices continue to hamper new home sales, despite high demand for

additional supply.

Across the country, consumers are feeling the bite of inflation and surging mortgage interest rates, which

recently hit 4.6% in March, according to Freddie Mac, rising 1.4 percent since January and the highest rate in

more than 3 years. Monthly payments have increased significantly compared to this time last year, and as

housing affordability declines, an increasing number of would-be homebuyers are turning to the rental market,

only to face similar challenges as rental prices skyrocket and vacancy rates remain at near-record low.

March – Local All MLS Numbers – Res & Condo Separated

Closed Sales decreased 8.7 percent for Residential homes and 12.6 percent for Condo homes. Pending Sales

decreased 6.7 percent for Residential homes and 18.2 percent for Condo homes. Inventory increased 1.4

percent for Residential homes but decreased 23.8 percent for Condo homes.

The Median Sales Price increased 8.5 percent to $229,000 for Residential homes and 15.0 percent to $230,000

for Condo homes. Days on Market decreased 16.2 percent for Residential homes and 42.6 percent for Condo

homes. Months-Supply of Inventory remained flat for Residential homes but decreased 26.7 percent for Condo

homes.

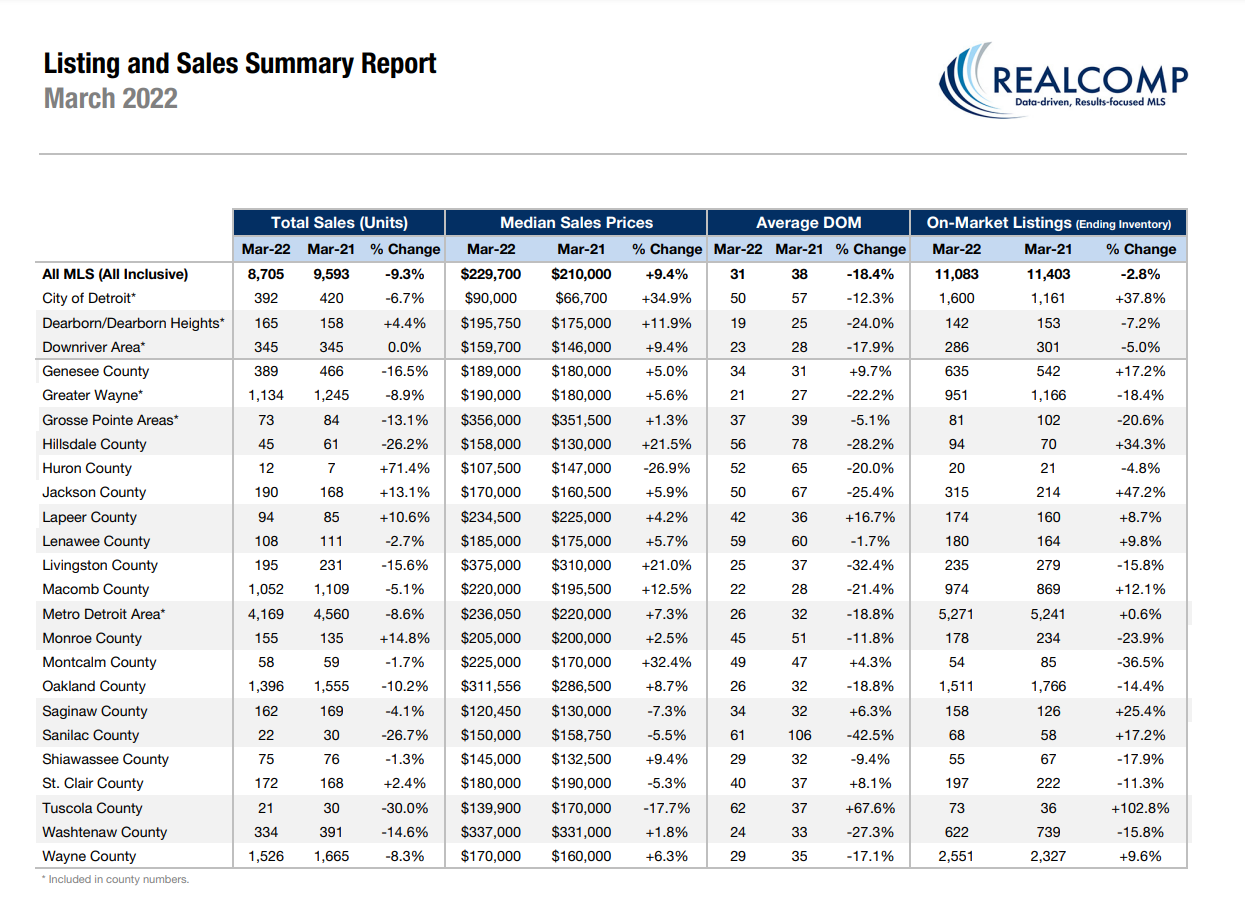

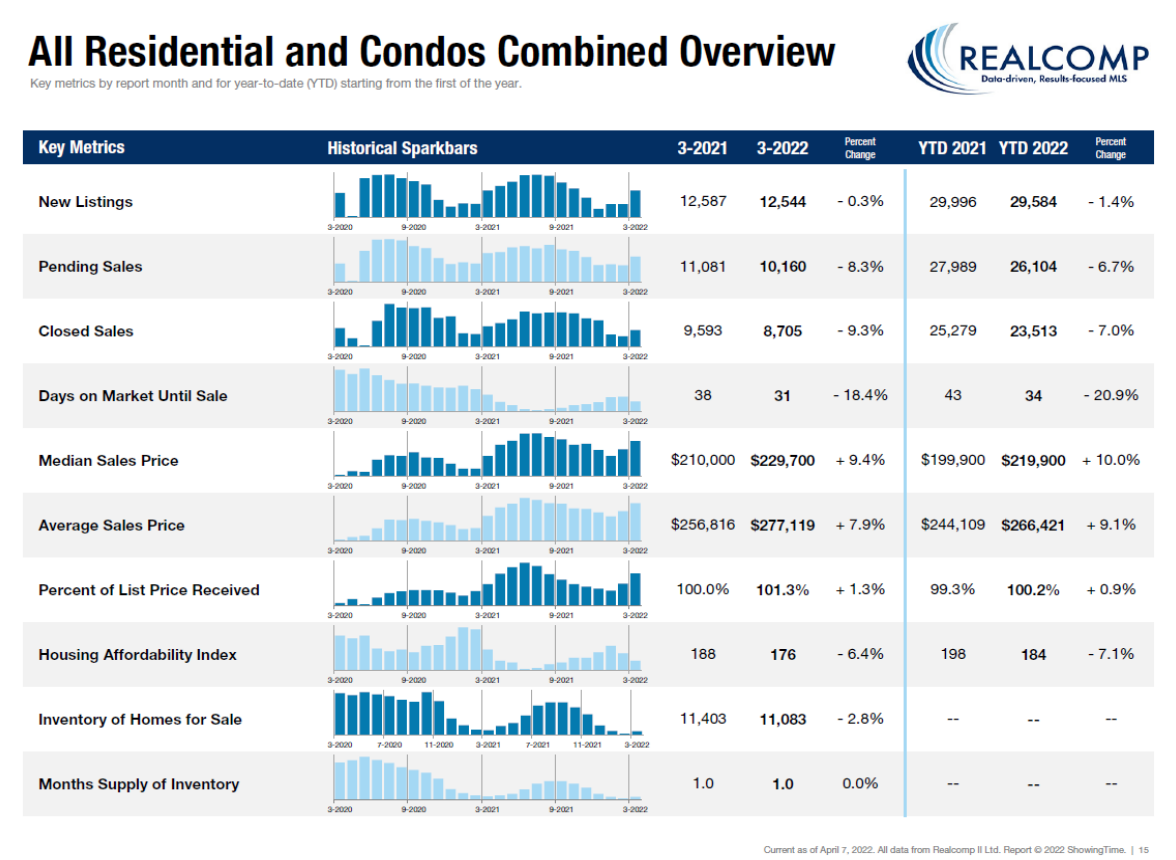

March – Local All MLS Numbers – Res & Condo Combined

March – Local All MLS Numbers – Res & Condo Combined

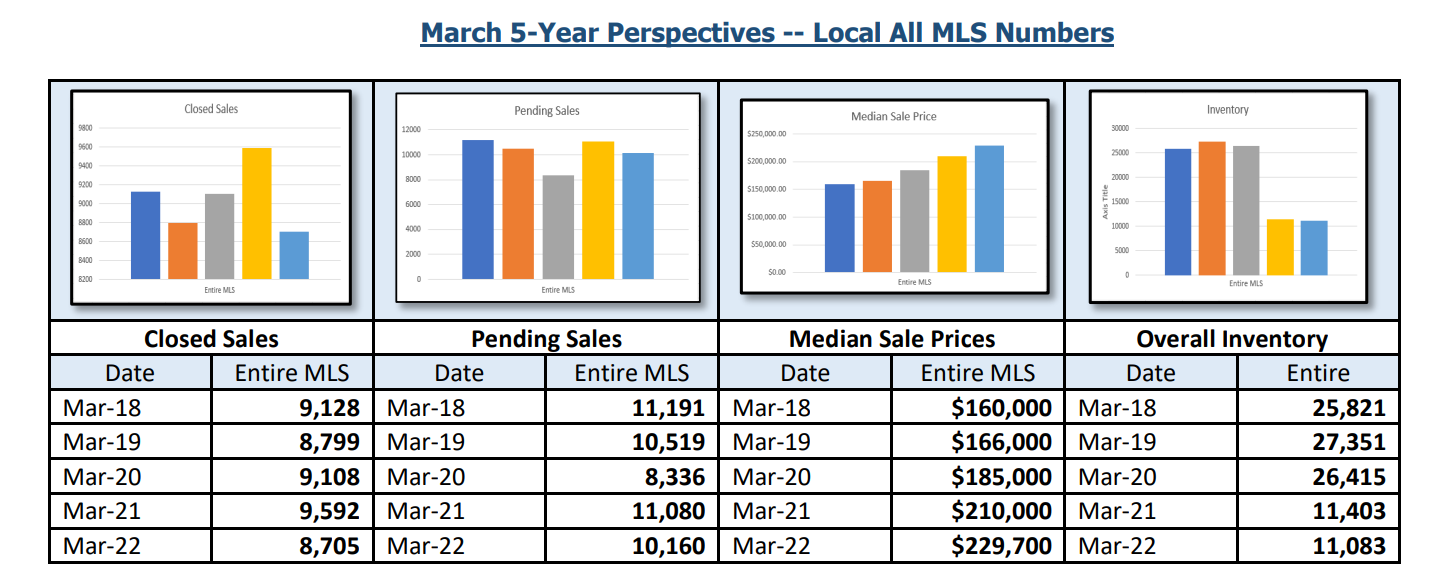

- Median Sale Price increased by 9.4% from $210,000 to $229,700.

- The average days on market (DOM) decreased by 18.4% from 38 to 31 days.

- The average % of the last list price received increased by 1.3% from 100% to 101.3%.

- New Listings decreased by 0.3% from 12,587 to 12,544.

- Average Showings per Home decreased from 19.5 to 17.4.

- Pending Sales decreased by 8.3% from 11,081 to 10,160.

- Closed Sales decreased by 9.3% from 9,593 to 8,705.

- Listings that were both listed and pended in the same month were at 6,431. This represents 51.3% of the new listings for the month and 63.3% of the pended listings.

- Months-Supply of Inventory remained the same at 1.0.

March 5-Year Perspectives -- Local All MLS Numbers