Inventory of Homes on Market

Increases Significantly in February

Overall Median Sales Price Rises Slightly

February – National and Local Real Estate Commentary

In its continued effort to curb inflation, the Federal Reserve raised its benchmark interest rate in February by a quarterpercentage point to 4.50% - 4.75%, its 8th rate hike since March of last year, when the interest rate was nearly zero. Mortgage interest rates have dipped slightly from their peak last fall, leading pending sales to increase 8.1% month-tomonth as of last measure, but affordability constraints continue to limit homebuyer activity overall, with existing-home sales

declining for the twelfth consecutive month, according to the National Association of Realtors® (NAR).

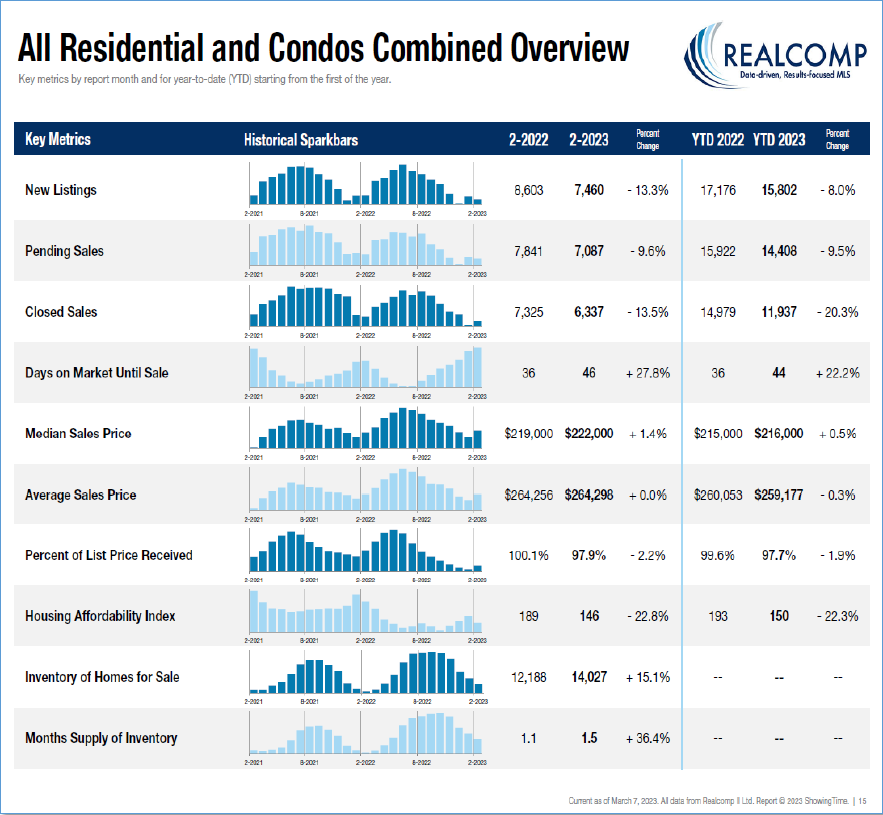

Closed Sales decreased 11.9 percent for Residential homes and 23.4 percent for Condo homes. Pending Sales decreased

9.4 percent for Residential homes and 11.3 percent for Condo homes. Inventory increased 14.8 percent for Residential

homes and 17.2 percent for Condo homes.

The Median Sales Price increased 1.8 percent to $222,000 for Residential homes and 1.8 percent to $224,000 for Condo

homes. Days on Market increased 24.3 percent for Residential homes and 31.3 percent for Condo homes. Month’s Supply of

Inventory increased 36.4 percent for Residential homes and 41.7 percent for Condo homes.

“Once again market factors are continuing to largely dictate activity,” said Karen Kage, CEO, Realcomp II Ltd. “At the same time, potential home buyers have more options to choose from without the competitive pressures

they were experiencing last year at this time.”

With buyer demand down from peak levels, home price growth has continued to slow nationwide, although prices remain

up from a year ago. Sellers have been increasingly cutting prices and offering sales incentives in an attempt to attract

buyers, who have continued to struggle with affordability challenges this winter. The slight decline in mortgage rates earlier

this year convinced some buyers to come off the sidelines, but with rates ticking up again in recent weeks, buyers are once

again pulling back, causing sales activity to remain down heading into spring.

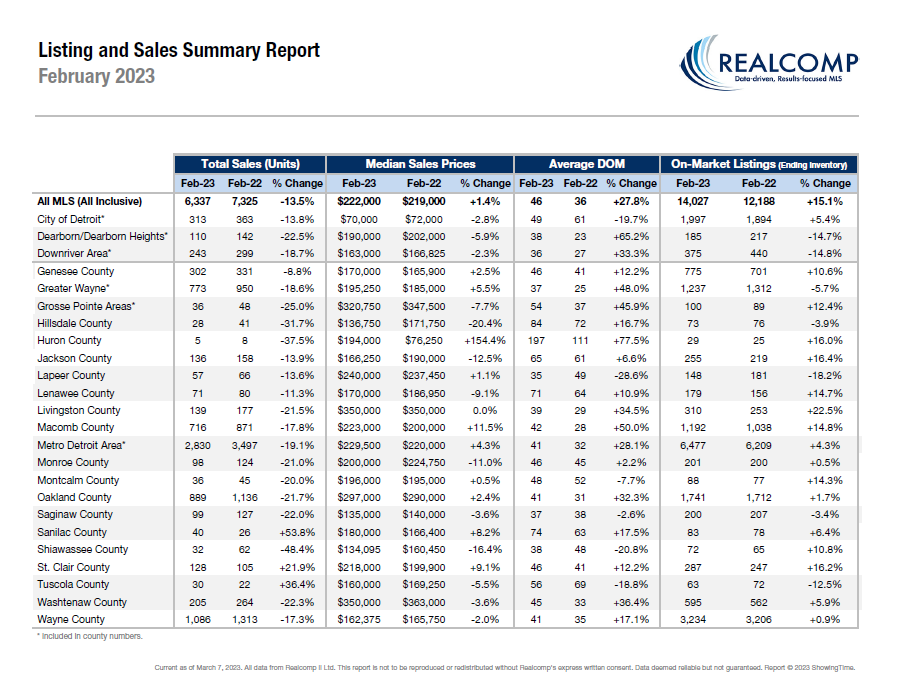

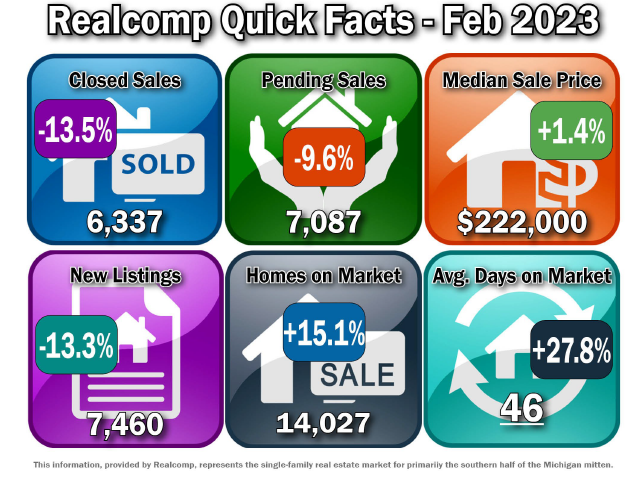

February Y-O-Y Comparison -- Residential & Condos Combined -- All MLS

- New Listings decreased by 13.3% from 8,603 to 7,460.

- Pending Sales decreased by 9.6% from 7,841 to 7,087.

- Closed Sales decreased by 13.5% from 7,325 to 6,337.

- Average days on market (DOM) increased by 10 days from 36 to 46.

- Median Sale Price increased by 1.4% from $219,000 to $222,000.

- Percent of last list price received decreased by 2.2% from 100.1% to 97.9%.

- Inventory of Homes for Sale increased by 15.1% from 12,188 to 14,027.

- Months-Supply of Inventory increased by 36.4% from 1.1 to 1.5.

- Average Showings per Home decreased by 4.2 from 14.4 to 10.2.

- Listings that were both listed and pended in the same month were at 2,874. This represents 38.5% of the new listings for the month and 40.5% of the pended listings.

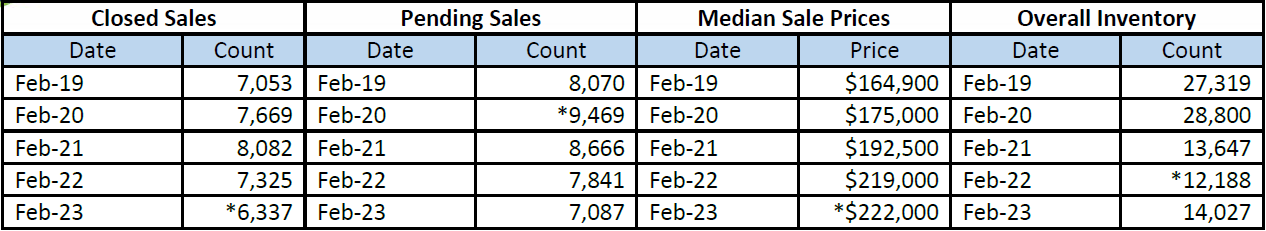

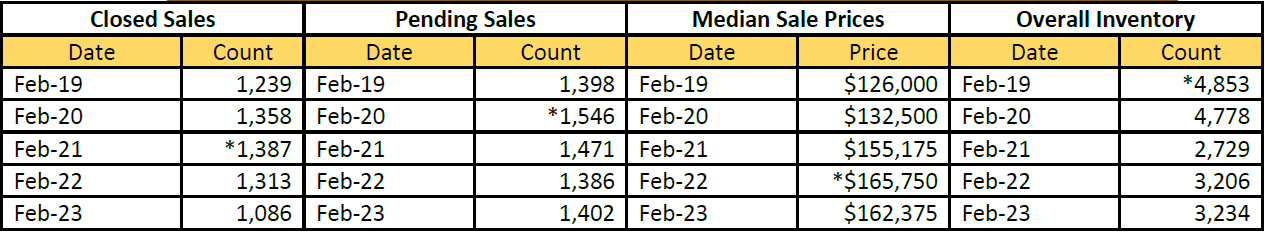

February 5-Year Perspectives -- Residential & Condos Combined -- All MLS

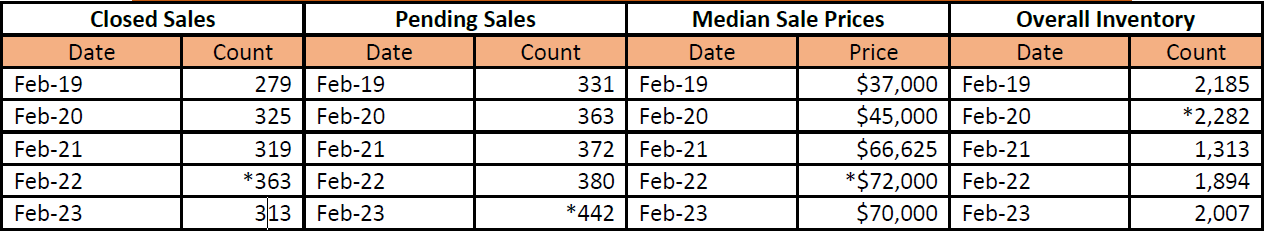

February 5-Year Perspectives -- Residential & Condos Combined – City of Detroit Numbers

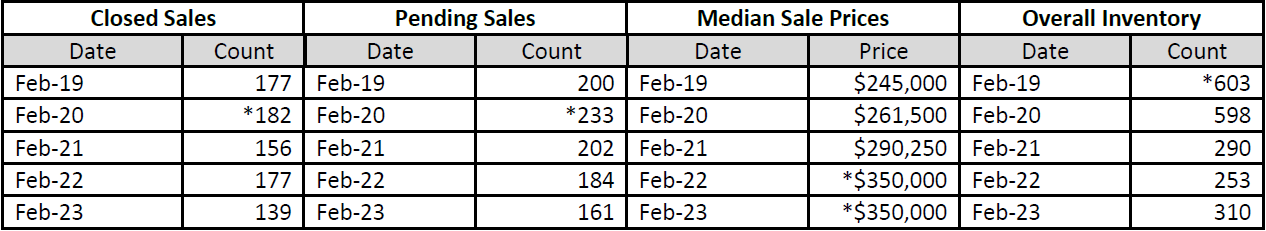

February 5-Year Perspectives -- Residential & Condos Combined -- Livingston County

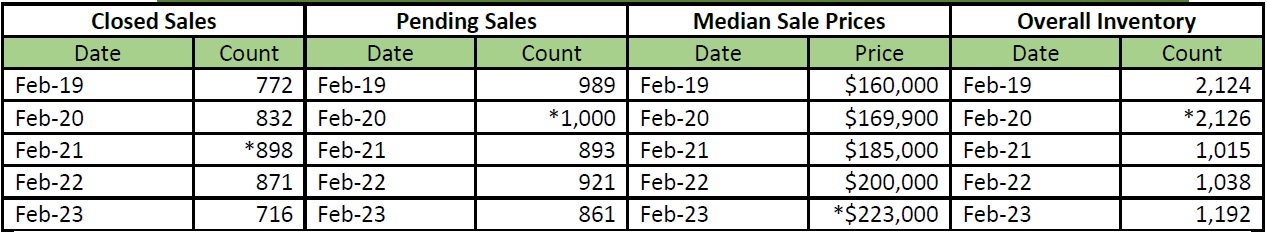

February 5-Year Perspectives -- Residential & Condos Combined -- Macomb County Numbers

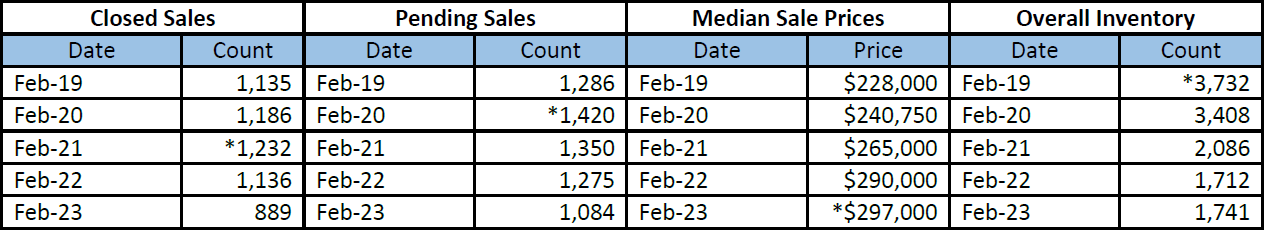

February 5-Year Perspectives -- Residential & Condos Combined -- Oakland County Numbers

February 5-Year Perspectives -- Residential & Condos Combined -- Wayne County Numbers

*high points noted with an asterisk.

It’s important to note that these numbers present a high-level view of what is happening in the real estate market in the lower part of Michigan and in specific regions. Be sure to contact a REALTOR® for their expertise about local markets.

Realcomp Shareholder Boards & Associations of REALTORS®:

- DABOR, Erin Richard, CEO, 313-278-2220

- DAR, Sharon Armour, EVP, 313-962-1313

- ETAR, Laura VanHouteghen, 810-982-6889

- GMAR, Vickey Livernois, EVP, 248-478-1700

- GPBR, Bob Taylor, CEO, 313-882-8000

- LUTAR, 810-664-0271

- LCAR, Pam Leach, EVP, 810-225-1100

- NOCBOR, Patricia Jacobs, EVP, 248-674-4080